Within this our third lesson, I am going to introduce you to some bookkeeping journals and ledgers. I will be introducing the sales and purchase journals which are the books of prime entry, (or first entry), for all of our credit transactions. To date I have introduced you to the Nominal (General) Ledger and to gain an understanding of this ledger we entered transactions directly to accounts within the Nominal Ledger. For reasons I will explain, we must NOT make entries directly into our Nominal Ledger.

To begin at Lesson One click here

Bookkeeping Journals And Ledgers

Keeping The Nominal Ledger Tidy

If we have a lot of customers who we invoice and allow credit terms then our ledger is soon going to become unwieldy. We may also have a number of suppliers who grant us time to pay their invoices. It is for these reasons that we must NOT be making entries directly into our ledger. We are also going to remove all of our suppliers and customer accounts into separate ledgers. The Cash A/c was another account where we were adding entries directly and this would build into one of our largest accounts, we are going to remove the Cash A/c. from our ledger and create a separate Cash Book.

Books of Prime Entry

We will now have our ledger divided into a Nominal Ledger, containing impersonal or nominal accounts; a Sales Ledger, containing the personal accounts of our customers; a Purchase Ledger, containing the personal accounts of our suppliers and a Cash Book.

We do not make entries directly into the ledgers, all entries are first recorded in our Cash Book or a Journal and these are our books of first entry, referred to as books of prime entry. The books of prime entry will be our Cash Book, Petty Cash Book, Sales Day Book, Sales Returns Book, Purchases Day Book, Purchases Returns Book and the Journal. N.B. Sales Day Book and Purchase Day Book are sometimes called the Sales Journal and Purchase Journal. A petty cash book is kept when a business has a separate amount of cash (coins and notes) from which small payments for say milk and coffee etc, are made.

The Sales Day Book (or Sales Journal)

We will be making sales either for immediate payment, when the cash will be entered into our Cash Book, or as a credit sale. It is the credit sales that are entered in our Sales Day Book. We will issue invoices in numerical order and our Sales Day Book will list in numerical order all of our credit sales invoices. Any cancelled invoice should be entered as such so that we can check that no invoices have been omitted.

Analyzing Our Sales

The t-shirt business we started has now grown to a turnover where we have to charge VAT. Also, we have acquired an embroidery machine and charge for embroidery on a shirt should the customer ask for this. Our sales invoices can now include the sales price of our t-shirts + embroidery charge + post and packaging + VAT. One invoice could have entries to four different nominal ledger accounts.

Example in Our Sales Day Book

On 5th June we sent invoice number 10072 to our customer In-Town Sports Co. for the following:

30 t-shirts at £5.00 each = £150.00

Embroidery Charge £50.00

Postage and Packaging £6.00

and VAT at 20% £41.20

making a total invoice value of £247.20

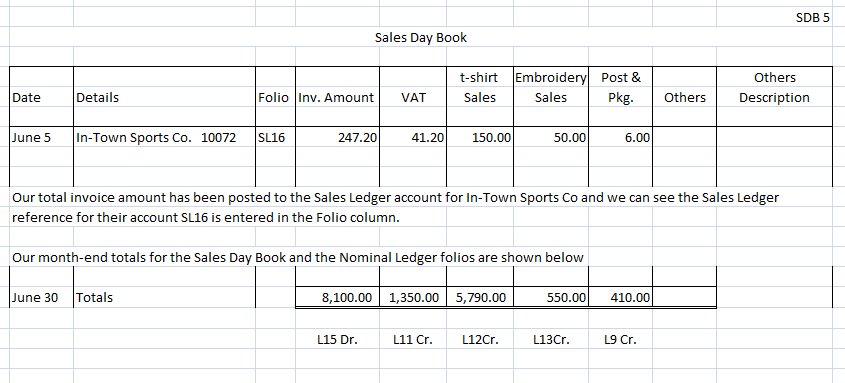

We are recording our sales invoices in a Book Keeping Analysis book from the Silvine range which has 32 pages with 7 columns for entries. Each book will accept about 900 invoices and these analysis books will be our Sales Day Books. The following shows our entry for invoice number 10072 in total and then analyzed to the four nominal accounts involved.

Keeping Nominal Postings to a Minimum

In order to keep our entries into the Nominal Ledger to a minimum, we wait until the end of the month and total all the columns in our Sales Day Book and then enter the totals for the month as a single entry to each of our nominal accounts. Our totals for the month of June are shown above. Having totalled all the columns we check that the sum of the analyzed columns (VAT £1,350, t-shirt sales £5,790, Embroidery sales £550, Post and Pkg £410 and Others nil) agree to the total of the Inv Amount column of £8,100.

Underneath each of the totals in the Sales Day Book we write the reference of the Nominal Ledger account we have posted to. £1,350 to our VAT account being L11 in the Nominal Ledger; £5,790 to our t-shirt sales account L12; £550 to our Embroidery Sales account L13 and £410 to our Post & Pkg account L9. As our customers are our debtors and their accounts have been debited, all of these entries in the Nominal Ledger will be the corresponding credit entries.

Having recorded the credit entries in our Nominal Ledger, we need to make a corresponding debit entry and this entry will be the total of our Invoice Amount column. This entry goes to an account called the Sales Ledger Control A/c, L15. As each invoice total was posted to the personal accounts in the Sales Ledger the entry to the Sales Ledger Control A/c. is the total of all the individual personal accounts we have posted to during the month. You will note we have shown Dr. for Debit beneath the Invoice Amount column and Cr. for Credit beneath the analyzed columns. Dr. and Cr. are the recognized abbreviations for Debit and Credit.

Sales Returns

There may be occasions when some items we have sold are returned to us and we raise a credit note to the customer, These credit notes are recorded in our Sales Returns Day Book, an analyzed book in similar form to our Sales Day Book. This time we will be crediting the customers’ accounts in the Sales Ledger and debiting the nominal accounts (crediting the Sales Ledger Control A/c.).

The Purchases Day Book

The invoices we receive from our suppliers will be entered and analyzed in our Purchases Day Book. As well as columns for Invoice Amount, VAT, t-shirt purchases, t-shirt printing and Embroidery Costs we may wish to include Printing and Stationery, Motor Vehicle Costs and other costs that arise on a fairly regular basis. We will leave two columns for “Other Costs” and “Description” (of the other costs).

The Purchases Day Book and Purchase Ledger are recorded similarly to the Sales Day Book and Sales Ledger. As our suppliers are our creditors we will be crediting their purchase ledger accounts with the invoice amounts and at the end of the month we will debit the individual nominal accounts and credit an account in our nominal ledger called the Purchase Ledger Control A/c.

Agreeing Invoices From Suppliers

Whenever we receive an invoice we need to

- Confirm we have received the goods or service charged

- Confirm the price charged is as agreed when we ordered the goods or service

- Confirm the invoice has been calculated correctly

Should we receive a credit note from our supplier for items returned, price adjustment etc. we will enter this in our Purchases Returns Book and analyze it similarly to the original supplier invoice. We will be debiting the purchase ledger with the value of the credit note received from our supplier and crediting the individual nominal accounts; debiting the Purchase Ledger Control A/c.

Month-End Tasks

The end of the month is a very busy time if we continue to keep our accounts manually. We have entries to make to our nominal ledger, balance the individual accounts and take out a trial balance.

In the Purchase Ledger we have to balance the accounts to show how much we owe each supplier and agree our balances to the statements we receive from our suppliers. We need to list all the outstanding balances in the Purchase Ledger and agree this overall balance to our Purchase Ledger Control A/c.

In the Sales Ledger we have to balance the accounts to show how much each customer owes us. We will then send our customers statements showing their balances outstanding. We will also need to list all the balances on the accounts and agree the overall total with the balance on our Sales Ledger Control A/c. in the nominal ledger.

Aged Debtor Analysis

Each month end we list all balances due to us and “age” the balances to show us which customers have balances up to 30 days old; the accounts that have balances outstanding between 30 and 60 days and the accounts having balances in excess of 60 days. These details are listed with the amounts outstanding for each account and the amounts that fall within each of the three time spans in a report known as an Aged Debtor Listing. Using this report we need to “chase” those customers whose accounts are overdue.

Credit Control

As a business owner you will want to ensure that you only allow credit to customers who are going to pay you within the agreed credit terms. The aged debt analysis is vitally important and may be the first sign of a customer experiencing cash flow difficulties. Having chased for payment and perhaps not received a response you may decide to cease trading with them.

Computerized Accounting Packages

With all these manual entries there is a risk of one or two errors being made and perhaps our trial balance does not agree or our ledger balances listing does not agree to the Sales or Purchase Ledger Control A/c. Errors could have occurred at any time during the month and sometimes can take an age to track down and correct.

All of this work can easily be handled by even the cheapest of computerized accounts packages.

The danger is that many people using computerized packages have little understanding of what the package is doing “behind the scenes”. As I have previously stated, when looking to employ someone in my accounts department I look to select someone who has basic accounting knowledge (as I am teaching here) rather than someone who claims to have knowledge of a computerized package.

Our computerized accounting package will provide all the reports we require, balance all of our accounts and will produce statements at the month end. All computer packages are based on these principles so if you have studied the basics you will be able to relate to what is happening within any computer package. For students interested in pursuing a career in Bookkeeping or Accountancy it is part of their training to know these basics.

Our next lesson will introduce the remaining books of prime entry, analyzed cash books and an explanation of two accounts that were mentioned during this lesson, the nominal ledger Sales Ledger Control A/c. and the Purchases Ledger Control A/c.

To progress to Lesson Four click here

Would having the skills to build and market your own websites benefit your business or employment? For our page on Simple Website Tutorials click here

If you have any comments or questions on small business bookkeeping, please leave your message below and I will be pleased to help.

Colin