This is the first page of our free bookkeeping course. This first section will give you the ground rules which you will take forward to all of your studies in Bookkeeping and Accounts. The subject is very easy and we hope we might persuade you to take up the subject with the objective of becoming a full-time or part-time bookkeeper or accounts clerk. We are also guiding this tuition toward business owners and managers to give them an understanding of the terms used by their financial advisers, together with an appreciation of how to control and forward plan their finances.

Free Bookkeeping Course Advice

Running or starting a small business, you are going to be an expert with the products or services you provide. Chances are, however, that you’ll know next to nothing about the bookkeeping and accounts side of your enterprise.

Will you just bag up all the bills, statements and copy invoices at the end of the year and hand them over to your accountant? I hope not. The accountant will probably take 15 hours or more putting everything in order and we all know professional time does not come cheap. Also, it will probably be months before he/she comes back to you to say how much profit or loss you have made and how much tax you are going to pay – much too late.

So who is going to do the paperwork? All these new businesses starting yet we have fewer and fewer bookkeepers. If you have just read that and thought this could be an opportunity for you – as a part-time or full-time bookkeeper – then please stay with us, I will help you all the way.

Returning to you, the business owner, we are going to show how easy it is for you, a trusted member of staff or a member of your family, to control your paperwork and financially run your business in order to make timely alterations as necessary. It is far easier to have a financial grasp of the business from day one than it is to catch up as it expands. You will also hold much more weight with your bankers or financiers if you can show you are on the ball financially.

How Will We Help?

We have contact with many professional accountants and, providing you can present well-kept records, we can obtain their services at really competitive prices. But why not involve us from the early stages? Tell us what you do or what you propose to do and we will suggest the financial bookkeeping options that could be best suited to your business. This is FREE advice and when you decide upon the method to follow we will again be available with FREE guidance if required.

Teaching Bookkeeping The Right Way

The number of people with bookkeeping skills has been in decline for a number of years and many smaller businesses are experiencing staffing difficulties. I spent some time teaching bookkeeping and accounts to adult classes and have proved that learning bookkeeping is EASY when “taught the right way”. I have provided lots of informative articles and the following tuition will enable you to grasp the basics of bookkeeping and accounting and how they might be applied to your business.

What Are Accounts?

You no doubt have a personal bank account where you can see the amounts that have been paid into your account, the amounts that have been paid out and the balance you have in your account at any given time.

A business can have 100’s or even 1,000’s of accounts. There will be accounts for people they deal with and also an account for every activity of the business. There will be an account for sales, purchases, rent, rates, advertising, staff salaries and many more.

Like your personal bank account, every one of your business accounts will hold meaningful information. We can track how much a customer has spent with us this year and compare that to the amount they spent with us last year. See how much we have spent on advertising this year, what were our sales for, say, August? We can even see how much our car cost us six years ago. Managing a business is all about asking questions and having the answers. Why has customer x spent less with us this year compared to last year? Are we spending too much on advertising? Which customers owe us money that is overdue?

Bookkeeping Basics Are Really Simple

All business transactions are conducted in one of just two methods of trading. We either buy/sell goods or services and make payment or receive payment at the time of the transaction OR we buy/sell and agree to make payment or receive payment at a later date.

What Does An Account Look Like?

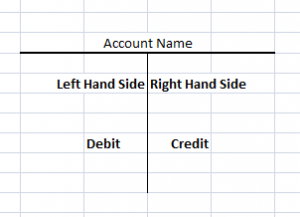

At this early stage I am going to liken an account to a letter “T”. Along the top of the T we would write the name of the account; the stem of the letter T divides the account into a left hand side and a right hand side.

The Four Basic Rules

I am now going to introduce four simple rules – learn and memorise these rules as 98% of bookkeeping and accounts revolves around these simple rules. Unlike in most courses and textbooks you will have learnt them early on.

RULE ONE

The left-hand side of an account is known as the DEBIT side and the right-hand side of an account is known as the CREDIT side.

Memorize this rule so that if you are told to debit an account or credit an account you will know which side to make the entry. (Debit = left side, Credit = right side).

The Cash Account

The main account of the business is the Cash Account. In this case “cash” means all forms of payment and receipt – cheques, direct debits, standing orders, charges direct to our bank account, receipts directly into our bank account as well as any transaction in actual cash (coins and notes). Learn the next rule for making entries to the cash account; you need to memorize the following:

RULE TWO

MONIES RECEIVED are recorded on the DEBIT side of the cash account (the left hand side)

MONIES PAID OUT are recorded on the CREDIT side of the cash account (the right hand side)

Credit Transactions

N.B. Take note that “credit” in “credit transactions” has a different meaning to the use in our “credit” side of an account.

Rules 3 and 4 relate to credit transactions. A credit transaction takes place when an invoice is raised with an agreement that payment can be made at a later date. An example might be our insurance company sending us an invoice which we have to pay before the due date. Similarly, we may have agreement with some of our customers that they can pay us, say, 30 days after our invoice date.

With all credit transactions we need to keep a record of the suppliers we owe money to and a record of the customers who owe us money. To do this we open an account in the name of our supplier or customer and record there the value of the invoice our supplier has sent us or the value of the invoice we have issued to our customer.

RULE THREE

The suppliers our business owes money to are known as our creditors and the customers who owe us money are our debtors. Rule three to memorize:

People or businesses that OWE US MONEY are our DEBTORS

and people or businesses that WE OWE MONEY TO are our CREDITORS

The rules for entering credit transactions are very logical, simply:

RULE FOUR

The customers we have invoiced and have not yet paid us are our Debtors and we DEBIT their account with the invoice total.

The suppliers who have sent us invoices which we have yet to pay are our Creditors and we CREDIT their account with the value of the invoice we have received

i.e. Debtors are Debited, Creditors are Credited.

Summary So Far

You will recall I said we either buy/sell goods or services and make or receive payment at the time of the transaction OR we buy/sell and agree to make or receive payment at a later date.

In the cases of immediate payment/receipt we will make entries into our cash account according to Rule Two.

In the case of credit transactions (where payment will be made or received at a later date) we will make entries in our books in accordance with Rules Three and Four.

These simple rules are used to cover all business transactions.

Double Entry Bookkeeping

Friar Luca Pacioli developed the double entry bookkeeping system back in the 15th Century and the system is largely unchanged today whether we are keeping our records manually or relying upon the various computerised packages. Without the double entry system we would not have the financial information available to efficiently run and control our businesses.

The rule for double entry is very simple; it says that EVERY DEBIT MUST HAVE A CORRESPONDING CREDIT ENTRY AND VICE-VERSA.

Introducing Nominal Accounts

So far I have introduced the cash account and the personal accounts for our debtors and creditors. I am now adding what are known as “nominal” accounts. Nominal accounts describe the nature of the transactions included in our cash account or personal accounts.

Let me demonstrate with some examples:

- we make a payment to a local printing company for supplying us advertising leaflets. We know from Rule Two that the cash payment is entered on the credit side of the cash account. We now make a corresponding entry on the debit side of the account which describes this transaction – we have a nominal account called “Advertising A/c.”. The double entry is Credit Cash Account and Debit Advertising A/c.

- we pay our staff their monthly salaries. Again we have a Credit to the Cash Account and we will Debit an account named Salaries A/c.

- customer purchases an item from us and pays us cash. We have received cash so we will Debit the Cash Account and Credit an account named Sales A/c.

- a customer, Mr A Mann, purchases an item from us and we hand him an invoice to be paid within the next 30 days. This is a credit transaction and Rule Three and Rule Four apply. Our customer owes us for items we have supplied and is a debtor so we Debit an account for Mr A Mann, the corresponding entry will be a Credit to our Sales A/c.

- the local garage, Bright Motors, have given us an invoice for repairs to our business van. We owe the garage for these repairs, the garage is a creditor so we Credit the account Bright Motors and enter the corresponding Debit in our Motor Repairs A/c.

You will recall that all transactions will be either cash transactions (involving our Cash Account) or credit transactions (involving personal accounts for our debtors and creditors). You know from Rules One to Four the first part of the transaction, so can always deduce the corresponding entry.

Practical Applications

As a student you might be asked “would the balance on your office furniture account be a debit or a credit?”. To answer the question you refer to the cash transaction taking place when you purchase an item of office furniture – it would be a payment and therefore a credit in the cash account, the corresponding entry in Office Furniture A/c. will be a debit. Answer to the question is “Debit”.

Now we have these nominal accounts added to our bookkeeping system we have access to information that can greatly assist in the control of our business. We can readily access information such as “how much was the repair to our van?”, we just turn to our Motor Repairs A/c and we have the answer. Similarly, we may want to know how much we are spending on advertising, we turn up the advertising account and all of our advertising spend is listed in this account.

The nominal accounts also provide the information for preparing our monthly and year-end accounts, showing whether we have made a profit or a loss and detailing the financial health of the business. We shall build up to the preparation of final accounts in further articles.

To progress to Lesson Two click here

If you have any comments or questions on this subject, please leave them in the area below and I will be very pleased to help you out.

Colin

AdminAdvice.com