The double entry bookkeeping example shown in this the second lesson of my free course, includes the information we need to add with each entry to our ledger. My first lesson likened an account to the letter T, which is an accepted method for learning the initial basics of bookkeeping. As I am sure you will understand just putting values on the debit or credit side of an account is not enough. In this lesson I start by showing the full entries as you would expect to find them in your business records.

To go back to Lesson One Click Here

The Ledger With Double Entry Bookkeeping Examples

The ledger is a book which contains all the accounts of the business. As the number of accounts grows you will reach the stage where a computerized accounting package will be more economical. Popular accounting packages and the free training available will be covered in a later lesson.

When you have an understanding of the manual bookkeeping system you will recognize how the entries are handled by your chosen computerized package. If I were selecting someone to join my accounts department the ideal candidate would firstly have an understanding of accountancy basics via manual system studies (which you are learning here), and secondly be familiar with our accounting package (or at least a very similar package).

Manual Ledger Entries

For the smaller businesses ledgers similar to exercise books can be perfectly adequate. For example the ledger from the “Silvine” range or the high street shop such as W H Smith’s “Double Entry Ledger – Book Keeping Account Book” which has about 40 lined pages for ledger entries.

Another option, and the one I have used for the following demonstration, is to create accounts within an Excel spreadsheet. Set the column widths and add vertical lines to give you the layout you would find in the ledger books. One advantage of using the spreadsheet is when you run out of space on any account you merely insert some extra rows. You add new accounts below the last one and continue working down the spreadsheet.

Recording My Business Transactions

Let us say that in January I started a new business. I am purchasing plain t-shirts, having them printed and advertise them on e-bay. My transactions in January were as follows:

- I deposited £1,000 into a business bank account

- I purchased 250 plain t-shirts and had them printed

- I purchased packaging materials

- I made 3 cash sales during the month and charged post and packing extra

- I had to pay the postage on the sales I made

- The local sports shop, In-Town Sports Co, collected some shirts from me (so no post or packing on this sale) and I agreed they could have 30 days’ credit.

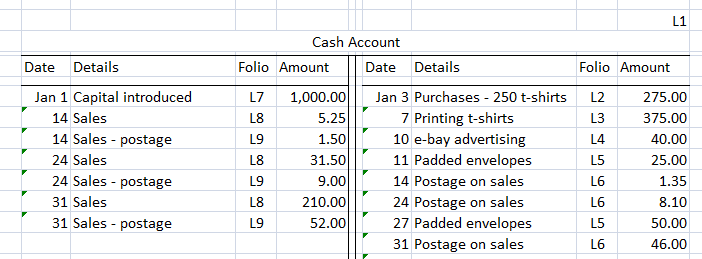

At the end of January my Cash A/c. with details of every transaction – the date, description and amount – read as follows:

Completing The Double Entries

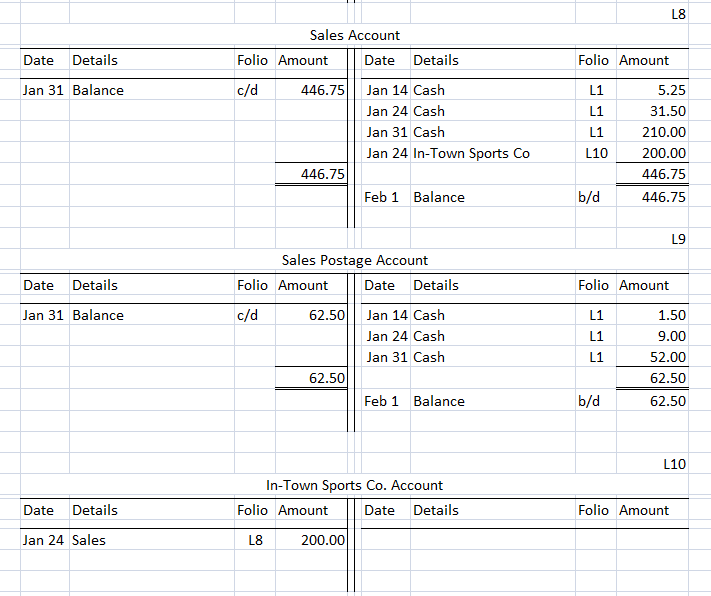

In the last lesson I introduced you to Double Entry Bookkeeping and I will now complete the double entries from my Cash A/c. and also add the credit transaction with In-Town Sports Co. Below I have added the nominal accounts (sales, purchases, advertising etc.) and the personal account of In-Town Sports Co. and numbered the accounts L1, L2, L3, onward.

You will see columns in the ledger accounts headed “Folio”. The purpose of the “Folio” column is to tell us in which account the corresponding entry can be found. You will see that the Cash Account is L1 and the double entry for the sales in that account will be found in L8 which is my Sales A/c. The entries in the Sales A/c L8 similarly direct us to L1 in the case of our cash sales and L10 for the credit sale to In-Town Sports Co.

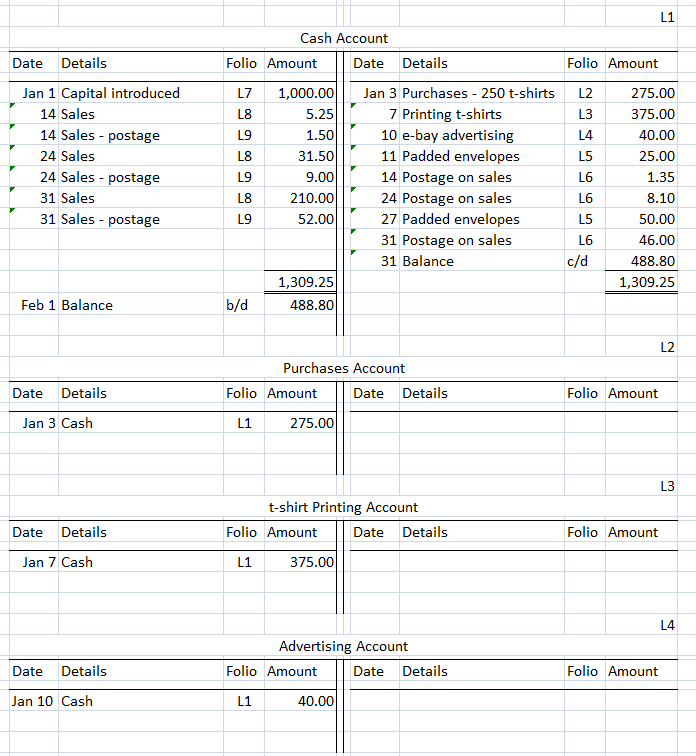

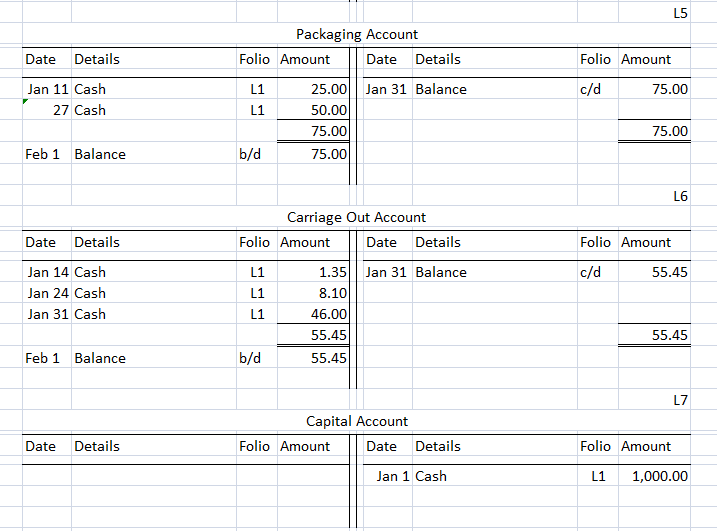

At the end of January, with all transactions entered, my ledger accounts read as follows:

Balancing Accounts

Where an account has more than one entry for the month we “balance” the account so that we start the new month with one figure only being the balance “brought down” (b/d). The b/d balance entry represents the double entry to the “carried down” (c/d) balance from the last day of the previous month.

To balance my account I want the debit side of the account to add up to the same sum as the credit side. If you now look at my Cash Account (L1) you can see at a glance that the total of the debit side will be greater than the total of my credits. To make both sides equal I will have to place an additional entry on the credit side. Firstly I write on the credit side the last day of the month (in January being 31) and under “Details” I write “Balance”. Underneath the bottom entry on the account (in this case the Balance entry I have just prepared) I draw a single line in the “Amount” columns. My debit side adds up to the largest figure so I total my debits and enter this sum beneath the single line I have just drawn. I then enter the same figure (1,309.25) under the single line I have drawn on the other side of the account. I still have to enter an amount where I made the entry “31 Balance” on the credit side and the amount to be entered there is the sum that will make our credit side add up to 1309.25; at the moment it adds up to 820.45. The balance figure I need to enter is 1,309.25 – 820.45 = 488.80. I have now made all the entries in the Cash Account for January and to show that has been completed I put a double underline beneath the “Amount” totals. Lastly I have to enter the double entry for the balances I entered on the credit side dated 31 January, and this will be on the next line down, a debit entry reading “Feb 1 Balance b/d 488.80”, I complete the double entry folio column by adding “c/d” to the 31 January Balance entry.

You will see that I have also had to balance the ledger accounts L5, L6, L8 and L9. Whilst the explanation for the way I balance an account is rather lengthy it is not as complicated as it seems, so please relate the same procedure to the way I balanced the other four accounts.

- Do be sure to only balance the accounts that have more than one entry in them for the period (month in my case).

- Place the totals on the same line, immediately under the lowest entry in the account.

- Put a double line beneath the totals so that you do not add the figures above the double lines into future totals.

- Make the folio entries c/d (carried down) for the balance on the last day of the month and b/d (brought down) for the balance entered for the first day of the new month.

The Trial Balance

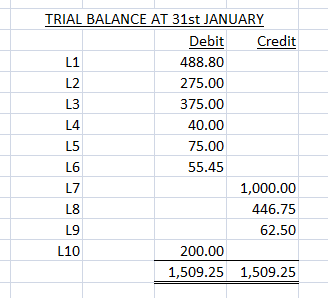

I am going to finalize my January bookkeeping by preparing a trial balance. Double entry bookkeeping requires that every debit entry has a corresponding credit entry. I list all the balances from my ledger accounts and total up all the debit balances and all the credit balances, the totals must be the same. My Trial Balance at 31st January reads as follows:-

My third lesson in this course will introduce other books (other than the ledger) you may find within a business. To progress to Lesson Three click here.

If you now have any comments or questions on this subject, please leave them in the area below and I will be very pleased to help you out.

Colin

AdminAdvice.com