All entries to the Ledgers arise from books of prime entry. In lesson three of our small business bookkeeping course we covered the Sales Day Book, Sales Returns Book, Purchases Day Book and Purchases Returns. We are going to start this lesson by looking at the remaining books of prime entry you will find within a business. We will then go on to explain the Sales Ledger Control A/c. and the Purchases Ledger Control A/c. These were nominal ledger accounts we referred to during lesson three.

The Analyzed Cash Books

Much of our cash book will be taken up by entries for money we receive from our debtors and entries for payments we make to our creditors. I am going to suggest we use books similar to the Silvine range Book Keeping Analysis Book. We will run a separate Receipts Cash Book and a Payments Cash Book.

Receipts Analyzed Cash Book

The columns in the Receipts Cash Book would include a Banked column, Totals column and then columns analyzing these amounts to Sales Ledger, Cash Sales, Others and Description. The Sales Ledger column would be for the amounts received from our debtors; whereas the Cash Sales column would record Cash Sales (sales made and paid for immediately).

When debtors make payments directly into our bank their payment will be recorded in the Banked column and analyzed to Sales Ledger. Our daily banking could be made up of cash sale takings plus some cheques received from our debtors. These amounts will be listed to our Totals column and analyzed appropriately, the one figure of banking for the day will be entered in the Banked column (and must be the total of the amounts listed in the Totals column for that day).

Payments Analyzed Cash Book

The columns in the Payments Cash Book includes a Total column which would be analyzed to Purchase Ledger; some columns for regular outgoings (perhaps Wages, Vehicle Expenses etc.); a VAT column; Others and Description.

A Cash Sales Analyzed Book

Our cash sales would need to be analyzed in the same way as our credit sales invoices were analyzed in our Sales Day Book. We will provide a separate set of Cash Sales Invoices and analyze these in our Cash Sales Book. In some businesses the amount of cash sales may be listed on till receipts. As we will be banking daily we will enter the total of our sales takings on one line in the Receipts Cash Book, being the total cash sales for the day, the entry being in the Totals column and Cash Sales column.

The Petty Cash Book

It is often necessary within the business to make some small payments in notes and coins. We may have to make the occasional reimbursement for parking fees, office refreshments, stationery, postage stamps, window cleaning, wages adjustments and many other sundry requirements. To cover these payments we hold a “float” of notes and coins known as Petty Cash. A record of these small payments is kept in another book of prime entry, the Petty Cash Book.

The Imprest System

An excellent way of controlling our petty cash spend is the imprest method. We first decide upon the level of cash we may need over a given period. Perhaps a float of £100 would adequately cover our weekly petty cash requirements. If at the end of the week the cash we have left is £20 we will complete a petty cash voucher to bring our balance back to £100, in this case £80. That petty cash voucher will detail the payments we have made during the week totaling £80.

Every payment we make from petty cash has to be justified by a receipt or a written explanation of the expenditure signed by a responsible member of the business.

Nominal Ledger Control Accounts

During lesson three we made reference to ledger accounts named “Sales Ledger Control A/c.” and “Purchases Ledger Control A/c.”

Sales Ledger Control A/c.

Our Sales Ledger contains the accounts of 10’s, 100’s or often 1,000’s of our customers. Every account in the Sales Ledger will contain details of every invoice and credit note we have sent to that customer, together with the payments we have received from our customer. Occasionally there may also be an adjusting entry recorded from our journal.

At the end of the month we list the balances on all of our Sales Ledger accounts and the total of this listing MUST agree to the balance on our Sales Ledger Control A/c. in the nominal ledger.

Let us consider why this would be:-

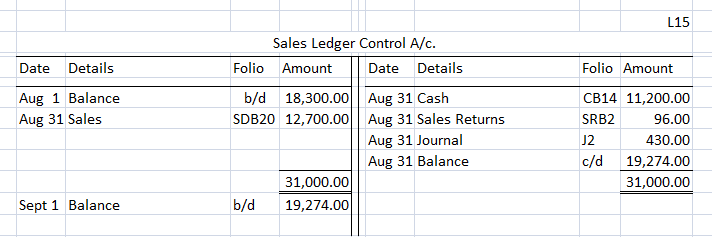

At the end of July we have 50 customers’ accounts in our Sales Ledger and the total of the balances from these accounts (listed in our Aged Debt Analysis) is £18,300. Our Sales Ledger Control A/c. in the Nominal Ledger agrees with this listing, the balance being a debit of £18,300.

During August we raise 24 invoices which are listed in our Sales Day Book and “posted” (entered) individually as debit entries to the relevant Sales Ledger customers’ accounts and total £12,700. Also during August we receive payments from 9 of our customers totaling £11,200. These receipts were entered in the Sales Ledger column of our Receipts Cash Book and the corresponding credit entries were posted to the relevant customer accounts in the Sales Ledger.

During August we also issued one credit note for £96 which was entered in the Sales Returns Book and posted to the credit of the customer concerned. We also made an entry in our Journal, clearing the balance of one customer as a Bad Debt (we cannot recover the sum owed by this debtor), posting a credit entry from our Journal to this customer’s Sales Ledger account for £430.

In our Sales Ledger we have made individual entries for 24 invoices, 9 cash receipts, 1 credit note and 1 journal entry. At the end of August we have balanced each of our Sales Ledger accounts and listed all the balances. Our listing comes to £19,274. At this stage we are hoping we have not made any mistakes entering figures in the Sales Ledger or calculating the balances on each account!

We need to check this sum to the balance shown on our Sales Ledger Control A/c. in the Nominal Ledger. Our Sales Ledger Control A/c. had an opening debit balance on 1st August of £18,300 to which we add the total for August from our “Inv. Amount” column in the Sales Day Book and deduct the total from our “Sales Ledger” column in the Receipts Cash Book, also deduct the value of the credit note we issued shown in the Sales Returns Book and the bad debt write-off from our Journal.

The Sales Ledger Control A/c in our Nominal Ledger reads as follows:-

Month-end balances agree with the control a/c., we can now go ahead and send our customers statements of their accounts.

During my early career I was accountant of a factory supplying sports goods to over 2,000 customers and we had a range of about 1,000 products. My accounts department included 13 hard-working clerks on the sales ledger side and 2 on the purchase ledger.

Purchases Ledger Control A/c.

The Purchase Ledger Control A/c. works in the same way as the Sales Ledger Control A/c. except, of course, being our creditors the balance on the account is a credit and as we receive invoices from our suppliers these are credited to our suppliers’ accounts in the Purchase Ledger and the Purchase Ledger Control A/c. When we pay our suppliers the entries are credits in our Payments Cash Book so the corresponding entries are debits to the suppliers’ accounts in the Purchase Ledger and the Purchases Control A/c.

Journal Entries

Our final book of prime entry is our Journal. Remember we do not make any entries directly into any of our ledgers, all entries must originate from a book of prime entry. If we have any adjustments to make which would not be entries into any of our other books of prime entry, then those entries are made in the Journal. The Journal must also have a full description of why the entry is being made.

In the Sales Control A/c. above we included one such entry, which was to write-off one of our debtor’s balance as it was irrecoverable. This entry would show in our Journal as a debit to the Nominal Ledger Bad Debts A/c. and credit to the account of our debtor in the Sales Ledger. Beneath the entry we would add “Write-off balance of JTP Supplies account (SL18) as the customer has been declared bankrupt”.

Next Lesson

We have seen how time-consuming the manual system of bookkeeping can be once a business reaches a certain level. In the next lesson we will look at setting up our nominal ledger accounts within a computerized package.

To continue to Lesson Five click here

We always appreciate hearing from you. If you have any comments or questions please leave them below and I will gladly reply.

Colin